General Dynamics still needs chips for its orders

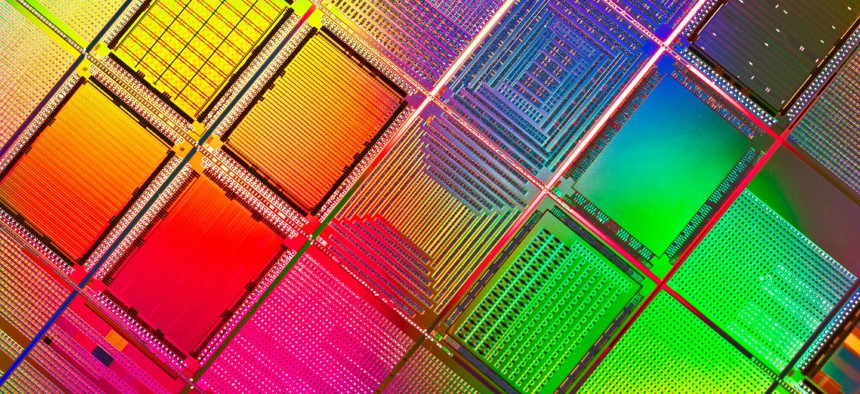

MirageC/Getty Images

The company's most short-cycled product business feels the semiconductor supply crunch more than the others.

Yes: an attempt to help alleviate the global computer chip shortage is on the way after both houses of Congress passed legislation on Wednesday to allot $52 billion in government funding for semiconductor manufacturing. But the so-called CHIPS Act will take some time to work through the entire ecosystem and companies still have to deal with the problems of today.

During General Dynamics' second-quarter earnings call with investors Wednesday, Chief Financial Officer Jason Aiken said the company's IT hardware business is "continuing struggle with a shortage of chips, which continues to plague their ability to deliver certain products."

General Dynamics is far from the only government technology company to cite the chip shortage as a drag on its financial and operational performance, as we have previously noted.

But the company specifically called out that there are not enough semiconductors to go around in both of its earnings calls in January and April, plus a majority of them in 2021.

Third-quarter revenue of $3 billion in General Dynamics' Technologies segment, which includes both the IT services and Mission Systems hardware businesses, was 5% lower year-over-year with two-thirds of that decline attributed just to MS and the chip shortage.

GD updated its full-year outlook for Technologies to $12.9 billion in revenue, right at the midpoint of the initial guidance range, and held to the forecast of a 10% operating margin.

After setting aside the IT services unit, Mission Systems is the most short-cycled product business GD has given that division's focus on communications and cybersecurity hardware predominantly for defense and space programs.

"These are highly engineered, high-end design engineering type products," Aiken told analysts. "The specifications are quite specific."

GDMS' team members may be out there trying to order chips and other parts ahead of need, but Aiken acknowledged it is "tough to get [their] spot in line."

"This is an issue affecting not just the industry, but the broader economy, but they're doing their best they can on that front," Aiken said. "They are also working to change designs, modify designs, accept alternate parts where they can and be as nimble as they can on that front, but that obviously takes some time."

Compounding that is how customers' ordering activity for many of those products that need said chips continues to be active, Aiken added. The Technologies segment's backlog stood at $13.5 billion as of the second quarter's end with $9.4 billion of it funded.

"For that side of the business, this is just a timing issue we've seen here," Aiken said. "If you take, for example, the second quarter and the product wasn't able to ship at the end of the quarter, we've seen the vast majority of that actually get shipped in the first month of the third quarter.

"So that is flowing through. It doesn't mean we're out of the woods yet. I think this is going to be something that's going to bug us for the balance of the year and maybe spill over a little into next year."

Erstwhile readers may have noticed by now that CEO Phebe Novakovic did not feature in this article. Aiken said she recently came down with COVID and is "on the mend and doing well," but still asked him to cover the call.