General Dynamics touts 'good trajectory' for tech hardware business

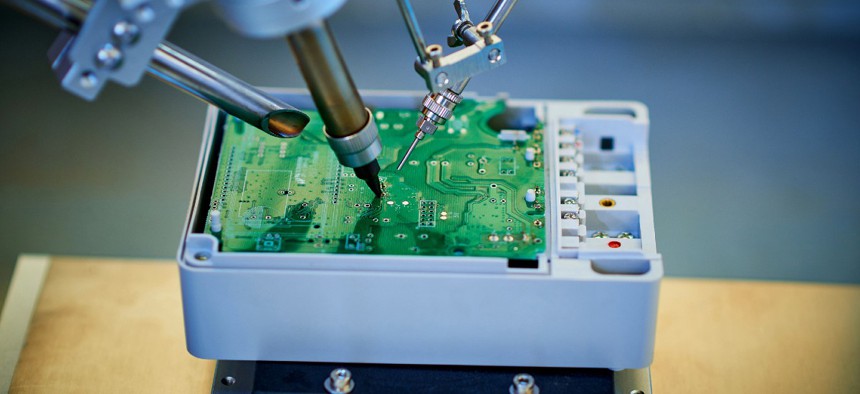

Gettyimages.com / Comezora

Chip supply and other bottlenecks appear to be easing and more clear for the company after several quarters of the opposite.

General Dynamics has for many months talked about the struggles to acquire enough computer chips and other parts to fulfill its order book as well as its efforts to get the situation under control.

Those efforts in particular at the mission systems hardware business appear to be paying off even as the company and its peers speak of supply chains as being in a "new normal."

During General Dynamics' first quarter earnings call with investors Wednesday, Chief Financial Officer Jason Aiken characterized the mission systems business as on a "good trajectory and gaining some traction" in the January-March period.

"That's part of the reason why volume was up nicely in the quarter, and they seem to be on a good path to overcoming that bottleneck in their system," said Aiken, also executive vice president of GD's technologies segment that houses the mission systems and IT services business units. "So that gives us confidence for the opportunities we have in the second half of the year."

First quarter revenue of $3.2 billion for the technologies segment registered a 2.5% increase over the prior year period, while operating earnings of $299 million were flat.

When GD reported fourth quarter and full-year 2022 results in January, Aiken told analysts the mission systems team ramped up product deliveries that had been held up in the third quarter because of supply chain logjams.

In essence, the past two completed quarters are a contrast to prior periods that GD spoke of as having the backlog in place without having the semiconductors and other parts needed to execute.

GD Mission Systems' internal actions have included expanding its search of alternate sources, certifying substitute parts, procuring key components of longer lead times between one and two years, and working with suppliers to improve forecasting of delivery and demand.

Backlog for the Technologies segment stood at $12.8 billion as of the first quarter's end. Analysts also asked for an update on why GD decided two years ago that the IT services and mission services units will be viewed together, at least on the financial reporting front.

"Those two businesses are seeing a real convergence on a number of fronts within their markets, what their customers are interested in procuring in terms of end-to-end solutions that include the IT service side, software solutions, as well as hardware," GD's chief executive Phebe Novakovic told analysts. "Bringing those two businesses together has put us on a good footing to address that market and those demands.