CEOs downplay anticipated gridlock on Capitol Hill, defense spending cuts

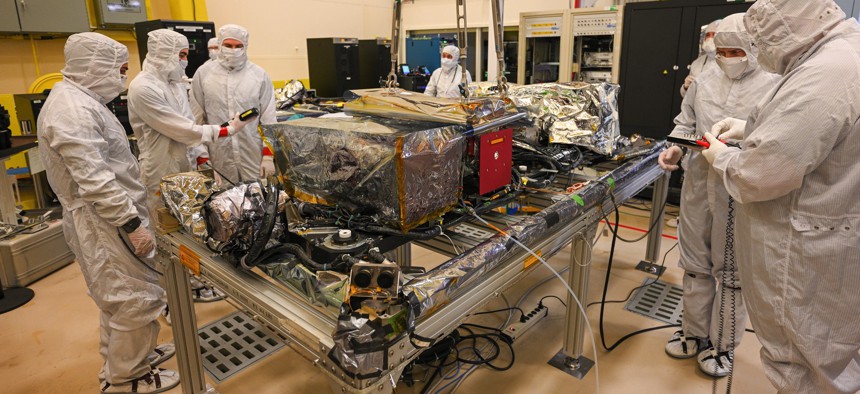

Lockheed Martin engineers prepare the U.S. Office of Naval Research-built Compact Coronagraph for space launch at the company’s location in Littleton, Colorado, in 2022. Lockheed Martin

The chief executives at Lockheed Martin and Raytheon also say pandemic-era supply-chain woes are subsiding.

The heads of America’s two largest defense firms downplayed anticipated gridlock on Capitol Hill and some Republicans' desire to cut military spending.

“It's really difficult for us to lay out what we think the budget process will be, given the nature of the House, Senate, and the administration right now,” Lockheed Martin CEO Jim Taiclet said on the company’s quarterly earnings call Tuesday. “But we expect that they are going to come together and do what's needed to defend the country and get the budget done.”

Raytheon Technologies CEO Greg Hayes also played down the potential for spending cuts while the United States is flowing arms to the besieged Ukrainian military and working to counter China’s military advancements.

“I think that is a very, very small subset of the Republican Party that thinks we're spending too much on defense,” Hayes said on CNBC after the earnings call. “It's just a very vocal minority that's not going to get any traction in Congress.”

Earlier this month, Rep. Kevin McCarthy, R-Calif., reportedly promised defense cuts to a small group of far-right Republicans in return for making him House Speaker.

McCarthy has since refused to raise the debt limit to cover federal spending agreed upon by the previous Congress. Lawmakers must agree on a plan to fund the federal government by the spring or else the U.S. could default on its loans and the government could shut down.

At the same time, U.S. companies have been experiencing supply-chain delays, worker shortages, and record-high inflation, which has delayed weapon deliveries.

Raytheon COO Christopher Calio said on Tuesday’s earnings call that wait times are decreasing for castings, rocket motors, and microelectronics, but not enough.

“While we are broadly beginning to see our supply chain improve, it is not yet at the levels we need,” Calio said. “We are assuming a recovery has moved into the back half of the year.”

Hayes, on the earnings call, said Congress’ inability to pass legislation allowing companies to get a tax break for research-and-development spending, will cost the company $1.4 billion this year. It cost the company $1.6 billion last year, he said.