M&A activity exploded in 2021. Here's why

Gettyimages.com/Tim Grist Photography

2021 saw an exponential increase in the volume of GovCon mergers and acquisitions with many deals driven by private equity buyers as well as large established companies. Will we see a repeat in 2022?

2021 proved to be the busiest merger & acquisition market that the defense and government technology services sector has ever experienced. Well-capitalized buyers, an abundance of financing, well-positioned targets, heightened valuation multiples, and a threat of increased capital gains taxes have motivated buyers to buy and sellers to sell, creating the perfect conditions for robust M&A activity.

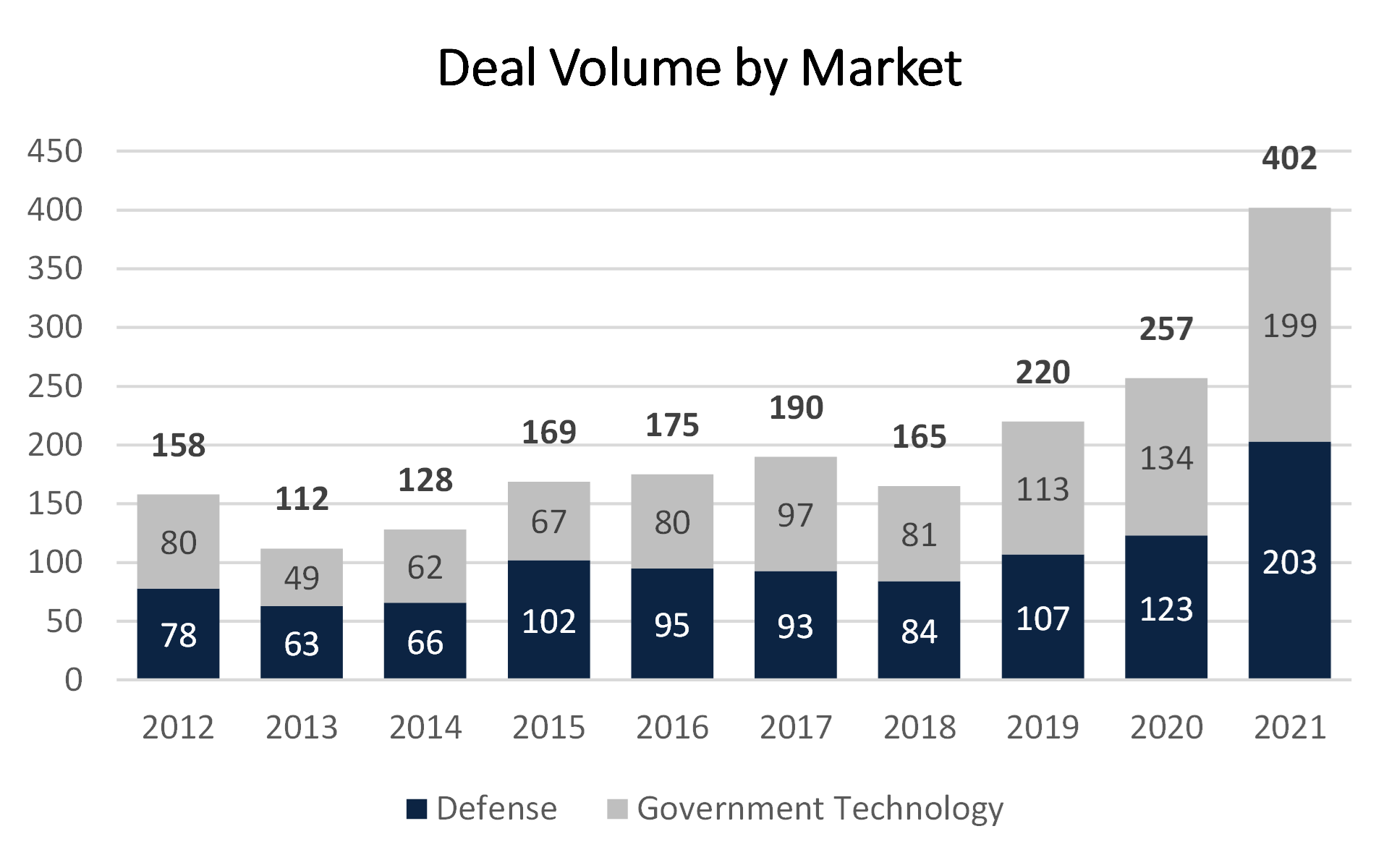

Across the sectors, more than 400 deals were announced in 2021, up more than 55% from 257 deals in 2020 and 83% from 220 in 2019. At a macro level, robust and growing federal budgets, historically high public company valuations, and affordable financing fueled buyers of all types to aggressively pursue M&A.

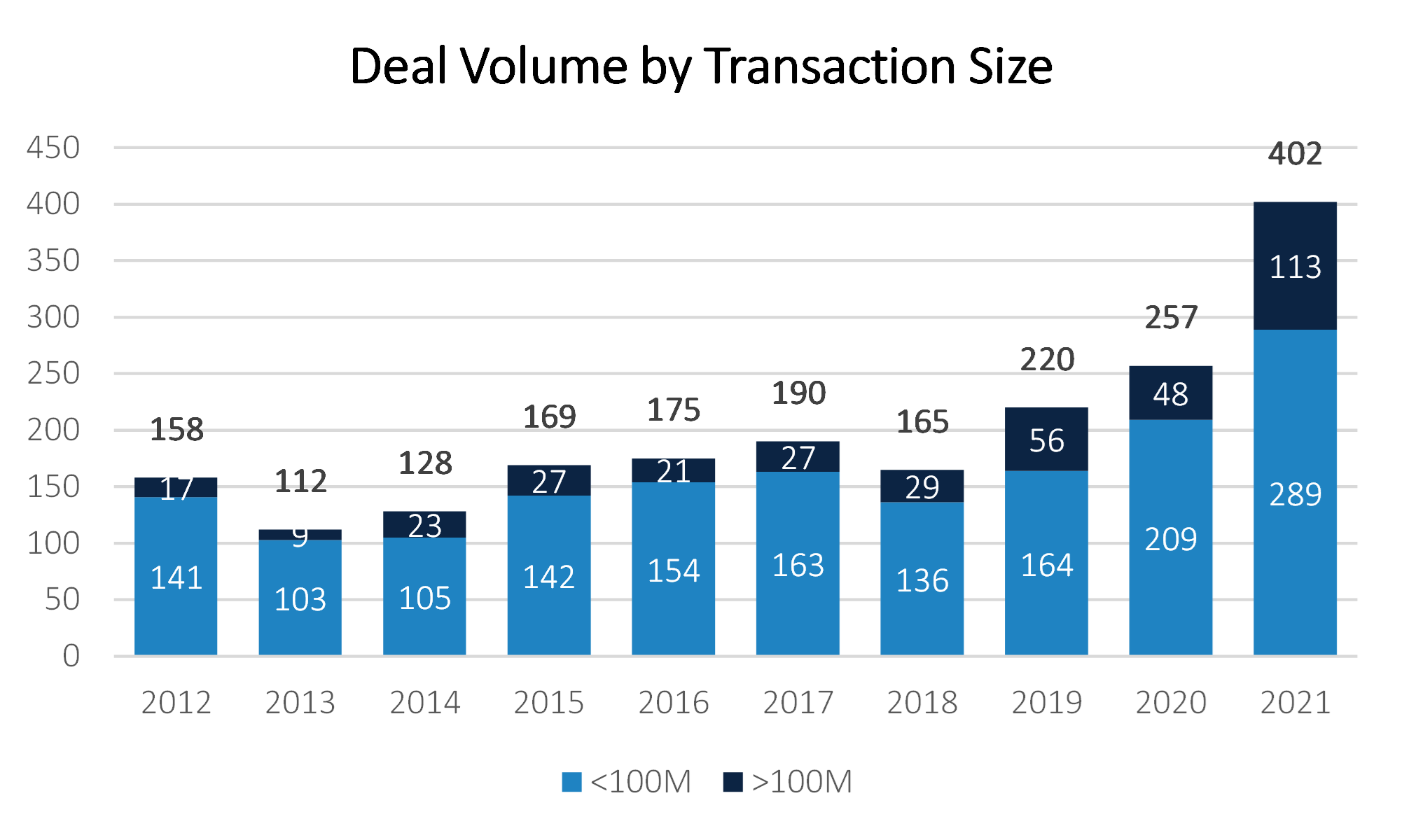

With respect to transaction sizes, in 2020, deals greater than $100M of enterprise value dipped to represent less than 19% of total deal volume, as buyers became more risk adverse during the initial phase of the pandemic. However, in 2021, larger deals increased as a percentage of total deal volume to almost 30%, which is well above pre-pandemic levels of ~25%. Strong market fundamentals, a roaring stock market, and a “double-down” mentality by private equity drove 2021 to be the busiest year for M&A to date.

Buyers are Following the Money

The current administration remains focused on expanding funding for civilian agencies, and domestic discretionary spending more specifically, primarily in areas of NextGen IT to advance specific mission objectives. The agencies expected to be the biggest beneficiaries are Health and Human Services, Veteran’s Affairs, Department of Education, and those focused on climate change initiatives.

As a result, interest in such areas, and in particular Health IT, is booming and traditional buyers, as well as some more commercially focused buyers, were eager to bolster civilian exposure via M&A in 2021. Key examples include SAIC’s acquisition of Halfaker, Veritas-backed Guidehouse’s purchase of Dovel Technologies, Capgemini’s acquisition of VariQ, and Maximus’ acquisition of Attain’s federal business.

While the administration is prioritizing civilian agencies, it has not signaled a desire to cut funding to the Department of Defense and the intelligence community as was initially feared when Biden won the election. While it is believed that selective budget cuts for new platform production may occur, the administration is thought to offset these cuts with increases in funding in areas expected to advance our military posture against threats from China and other global adversaries.

These areas include: national security; space and satellites; hypersonics; electronic warfare; research, development, test and evaluation; cybersecurity; and IT modernization. Given these trends, interest in DoD/IC targets remains high. Noteworthy 2021 DoD/IC deals include: Accenture’s acquisition of Carlyle-backed Novetta; CAE’s purchase of L3Harris’ Military Training business; Serco’s acquisition of HIG-backed WBB; and ManTech’s purchase of AE Industrial Partners (“AE”)-backed Gryphon Technologies.

Public Valuations Near or at all-time Highs

Over the past ten years, government technology services and defense public company stock prices have considerably outperformed the S&P, despite the tech-driven S&P run up since the beginning of the pandemic. Since the pandemic-related dip in March of 2020, both sectors have rebounded and are now trading around pre-pandemic levels, which is in line with all-time highs.

Similarly, median public company valuations (represented by Enterprise Value/LTM EBITDA) remain near pre-pandemic levels of ~12x and ~13x for the GTS and Defense sectors, respectively. Strong stock performance, coupled with historically high public valuations, is allowing public buyers to pay elevated M&A multiples without diluting stock prices. As such, a number of transactions took place in 2021 at premium valuations, including Booz Allen Hamilton’s acquisition of Liberty IT Solutions for nearly 14x EBITDA and Teledyne’s purchase of FLIR for approximately 18x EBITDA.

Many more acquisitions are suspected to have transpired at these levels and potentially higher, that were not made public. Despite robust public pricing, the elevated M&A pricing has led certain public companies, such as Perspecta and PAE, to exit the public markets by selling to non-public buyers.

Private Equity Continues to Stimulate Midmarket Demand

Over the past decade, there has been a proliferation of private equity interest in the Defense and GTS marketplace and today Private Equity Groups (“PEG”) play an undeniably critical role in mid-market M&A. The typical PEG playbook is to acquire midsized companies, partner with management to refine and execute on organic growth strategies, and supplement with strategic add-on acquisitions to create larger and more mature businesses that become ideal M&A targets for public acquirors. Over the past decade, PEGs as buyers have increased from approximately 30% of total volume in 2012 to nearly 50% in 2021.

Despite 2021 being a “sellers’” market given elevated M&A valuations, PEGs across the sector bought 180 businesses and sold just 46. Of the 191 acquired companies, 67 were new platform investments and 124 were add-on acquisitions to existing companies. Industry veterans such as Arlington Capital, Audax, Carlyle, KKR, and Veritas, among others, remained highly acquisitive in 2021, both adding on to existing portfolio companies and making sizeable new portfolio investments.

At the same time, more recent entrants, such as AE Industrial Partners, Arcline Investment Management, and Sagewind Capital continued to ramp up M&A in the sector. Noteworthy private equity transactions include Arlington Capital’s acquisitions of SPA and MCR, Sagewind-backed QuantiTech’s acquisition of Millennium Engineering & Integration Company (“MEI”), and Arcline’s acquisitions of BEI Precision Systems and Space (“BEI”) & Air Comm Corp. In addition, many of these and other private equity firms focused on the sector raised new funds in 2021, another sign that they remain bullish on the sector over the medium to long term and remain committed to deploying more capital.

Will the Momentum Continue?

While it may be a challenge to break another record with respect to total transaction volume in 2022, the M&A market appears to be off to a strong start to the year. Public acquirers continue to signal strong appetite for M&A and the private equity landscape is as healthy as ever, ensuring continued buyer demand and supply of attractive targets.

As long as budgets remain strong, midsized companies should continue to perform well, creating a supply of motivated founder-run sellers. Buyers are currently using M&A to expand exposure across both the Civilian and DoD/IC markets. In addition, buyers seek M&A to: add scale; expand in-demand capabilities (e.g., NextGen IT, Space, etc.), differentiated solutions, and intellectual property; and gain prime positions on sought-after Best-In-Class contract vehicles.

As such, M&A is a critical component used to advance organic growth strategies and with a plethora of well-capitalized buyers, M&A should continue to flourish.

About the author: Kate Troendle is a managing director with KippsDeSanto & Co. and has approximately 15 years of M&A experience. She is a graduate of Vanderbilt University and McDonough School of Business at Georgetown University. She may be reached at ktroendle@kippsdesanto.com.

By

By