HII sees acquisitions as bolstering growth beyond surface ships

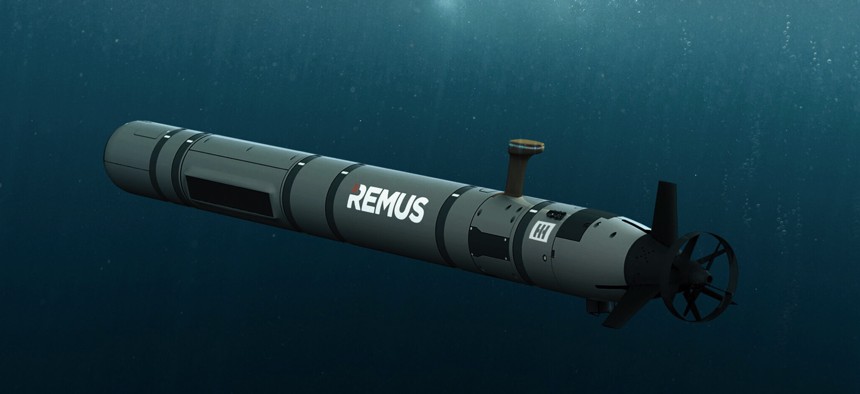

Artist's conception of HII's REMUS 620 medium-class unmanned underwater vehicle. HII

The nation’s largest shipbuilder expects “mission tech” like artificial intelligence and undersea drones to outpace revenue from surface combatants.

As the U.S. military makes moves to counter China and deepen alliances in the Pacific, HII finds itself in a unique position.

HII is the country’s largest warship builder, its only supplier of aircraft carriers and amphibious ships, and one of just two companies that builds nuclear submarines.

But the company formerly known as Huntington Ingalls Industries has broadened its portfolio in recent years as the Pentagon shifted its focus away from counterinsurgency operations toward countering China’s military buildup.

“We're really in a sweet spot relative to the products and technologies that we sell and support of everything going on in the Pacific,” HII CEO Chris Kastner said in an interview. “We have…supplemented the company's capabilities over the last few years with an eye towards technology investment.”

Key acquisitions—unmanned underwater vehicle maker Hydroid in 2020, Alion Science & Technology in 2021—have given HII access to a welter of new technologies that are at the center of the Pacific shift.

Those include artificial intelligence, machine learning, cyber, live virtual constructive training, autonomy, big data, and electronic warfare and intelligence, surveillance and reconnaissance. The fields are also expected to be part of the deepening ties between Australia, the United Kingdom, and the United States through the AUKUS pact.

“We've gradually built up, and then culminating with the Alion transaction, where we've got a $2.5 billion business that aligns really perfectly with what their priorities are,” Kastner said.

In fact, HII executives expect the non-shipbuilding Mission Technologies division to produce one-quarter of company revenue—more than Ingalls Shipbuilding, the division that builds amphibious ships, destroyers, and cutters. Still, they view HII as a shipbuilding company, at least for now.

“Our primary strategy really is getting the ships that are under contract delivered to the fleet to execute their mission,” Kastner said.

The company, which reported $10.7 billion in revenue in 2022, is expected to deliver five ships this year. Its outlook is growing even as U.S. military budget growth right now looks flat.

“Total obligational authority for major HII shipbuilding programs may suggest a flattish multi-year outlook,” Capital Alpha Partners analyst Byron Callan wrote in a recent note to investors. “However, Congress is likely to add to programs, there should be overhaul and repair work, and other DOD spending categories should contribute to Mission Technologies.”

In written testimony to the Senate Armed Services Committee last week, Defense Secretary Lloyd Austin mentioned several technologies he needs to counter China.

“The department is also accelerating investments in cutting-edge defense capabilities, such as uncrewed systems that can operate on the water, underwater, in the air, and on land,” Austin wrote. “Integrating human-machine teaming, autonomous systems, and resilient networks will make our operations significantly faster, more lethal, and more survivable.”

On top of that, the Biden administration in mid-March announced Australia would acquire between three and five Virginia-class attack submarines, while the U.S. and U.K. submarine forces would launch a plan for rotating through Australia. Finally, the U.K. and Australia will collaborate to design a new submarine for both countries to build.

The AUKUS agreement also includes a second “pillar”: collaboration on artificial intelligence, hypersonics, quantum computing, and other advanced technologies.

“Those technologies in Pillar Two align directly with what we made our investments in,” Kastner said. “We see that as a lot of opportunity, not only domestically, but within the U.K., Australia.”

As the Pentagon shifts focus to the Pacific, military leaders have increasingly talked about how combat logistics across a vast and vulnerable swath of the Earth’s surface will be far tougher than they were in Iraq and Afghanistan.

Kastner said the company’s “big data” technology can play a major role in routing and repositioning ships, supplies, and equipment if one is attacked.

“If there's a fight, [it] will happen so quickly, that you need [artificial intelligence and machine learning] tools in order to ensure that your logistics are supported, so you can make very quick decisions,” he said.

Kastner touted the company’s drone submarines and their ability to be used as a “sensor node that can add to your picture of the battlefield.”

The company has delivered more than 500 unmanned submarines, with roughly 30 percent going to U.S. allies in the Pacific and elsewhere.

“I do think there'll be a ramp in unmanned vessels developed,” he said. “I don't know how materially it will ramp, but we'll play a part in it because we're the largest producer of unmanned undersea vessels for the Navy.”

While the Navy touts goals of having 40 percent of its fleet being uncrewed ships and submarines by 2040, so far, it has primarily used drone craft in exercises.

Meanwhile, Kastner sees amphibious ships playing a role in the Pacific, pointing to recent Navy exercises. HII makes San Antonio-class transport docks and America-class small-deck aircraft carriers, both of which carry Marines.

“I think it's really well understood that amphibs play a really important role in presence in the Pacific to keep that body of water safe for trade,” he said. “I think it's widely known and accepted that LPDs play a critical role in that mission.”

The Navy’s plans for the San Antonio-class ships are unclear. The Office of the Secretary of Defense ordered a pause in purchases so it can evaluate the need and cost. Its fiscal 2024 budget proposal includes no money for LPDs, but the Marine Corps put one on its unfunded priority list. Late last week, the Navy awarded HII a $1.3 billion deal for LPD-32.

The company is rapidly hiring workers to meet the expected demand. Its two shipyards, Ingalls and Newport News, brought on about 5,000 workers in 2022 and plan to hire about the same number this year to prepare for future work.

“We're essentially fully staffed in both yards,” Kastner said.

Like other shipbuilding companies, HII has created training and apprentice schools to produce welders and other specialists, and has expanded recruiting efforts at community colleges and high schools.

“The old days of just the shipbuilder walking in applying and staying on the job, I think those are behind us,” Kastner said. “We've had to make more investments in focusing on our established programs, and increasing the training at both shipyards in order to keep the shipbuilders here.”

NEXT STORY: IAP hires new chief executive