Who's your private equity buyer?

The government market has seen a resurgence of M&A in the past two years with one large deal after another. But who the most active and aggressive buyers are might surprise after reading this first piece in a four-part series by acquisition experts Marc Marlin and Kate Troendle.

Since 2017, the federal government technology solutions (“GTS”) marketplace has experienced consistently strong M&A activity with more than 150 announced transactions. Department of Defense and civilian agencies are experiencing significant budget increases, public companies are trading at record high valuation multiples and forecasting high single-digit organic growth, and lenders continue to provide attractive M&A deal financing.

These factors have contributed to an increase in buyer demand and often a willingness to pay premium valuations for well-positioned acquisition targets. But who has emerged as the most active buyers and who has been the most aggressive? And who’s your buyer? The answer may surprise you.

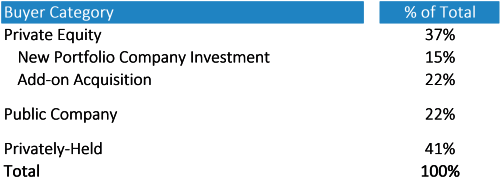

Most sellers envision a large public company sweeping them off their feet. But in practice, this represents less than a quarter of GTS transactions. The M&A landscape and buyer universe is far more diverse, presenting a myriad of attractive buyer alternatives.

Government Technology Services - M&A Landscape (January 1, 2017 – September 30, 2018)

Sources: CapitalIQ, SEC filings, KippsDeSanto research

We have analyzed buyer habits over the past four years and will be summarizing the results in a series of four articles, each one focused on a specific buyer category. This first article below focuses on private equity interest in the GTS sector. We will then touch upon the buying habits of public companies, non-traditional buyers, and mid-tier private businesses.

First up: private equity.

While PE has a long history of investing in the GTS marketplace, recent years have seen increased interest and considerable buying and selling activity from this buyer group. Firms like Arlington Capital Partners, the Carlyle Group, CM Equity, DC Capital, GTCR, Riorden, Lewis and Haden, and Veritas Capital to name just a few, represent some of the most longstanding PE players in the sector, each having made numerous investments in GTS platform companies over the past two decades and most having raised new funds in recent years.

Over the past several years, additional firms have focused on the sector such as AE Industrial Partners, Blue Delta Capital, Enlightenment Capital, and Washington Equity Partners among others. In addition, some established yet sector diversified firms such as H.I.G. Capital, Lindsay Goldberg, and Macquarie Capital have expanded their interest in the federal marketplace.

Attractive market dynamics, increased sector awareness, and favorable financing have been key drivers for this increased sector focus. Not only are more firms investing in the sector, but they have become increasingly aggressive and at times outbid strategic buyers in competitive M&A processes.

Since 2017, PE buyers making new portfolio investments -- platforms -- represented 22% of total announced transactions, while PE portfolio companies making add-on acquisitions to pre-existing platforms, represented another 15% of total transactions. Combined, PE played a buying role in 37% of all deals, a considerable increase from just 23% in 2016. Also noteworthy is that PE were sellers of platforms in 15% of all transactions since 2017.

So in aggregate, PE was a buyer 2.5 times more often as they were a seller. This illustrates PE’s commitment to the sector, even when currently high M&A valuations would suggest that it may be a good time to be a seller.

Recent examples of PE making big bets on the sector and picking up well positioned targets include: Veritas-backed Alion Science and Technology acquiring intelligence, defense and special operations firm MacAulay Brown; AE Industrial Partners-backed Belcan making a series of investments in the federal space including DOD-focused Schafer Corp.; CM Equity acquiring defense and homeland security firm Systems Planning & Associates; Bridge Growth and Frontenac-backed Salient CRGT purchasing defense and health firm Information Innovators; and Arlington Capital acquiring defense and intelligence-focused Integrity Applications Inc. and Xebec.

PE firms play a critical role in middle-market M&A, and especially with respect to enabling public companies to execute on their M&A strategies and objectives. Since 2015, public companies represented the buyer in nearly half of all sales of PE-backed portfolio companies. Over the same time period, public companies represented the buyer in approximately 25% of all non-PE backed sale transactions, making public companies almost twice as likely to buy a PE platform as compared to a privately held business.

PE has been successful in the marketplace buying mid-tier businesses and then helping management to refine and augment organic growth strategies as well as make strategic add-on acquisitions. The result is often a business with more refined market orientation and/or increased size and scale, which enhances the attractiveness to public companies, who have been highly selective in recent years. With the GTS sector back in vogue, coupled with low capex and high cash flow generation characteristics, PE interest in the sector is showing little sign of softening.

Look for our second article in this series next week, in which we will share recent M&A buying trends of public companies.

NEXT STORY: Vectrus hires Boyle as general counsel